The insurance industry has the potential to automate over 55% of back-office processes by 2025, resulting in time savings of 66%.

(McKinsey)

Boost your company's success through the pioneering implementation of automation. Start a future-proof and sustainable journey with efficiency, productivity and innovation and secure a clear competitive advantage.

Over 35%

lower costs for claims processing

Over 55%

of back-office processes can be automated

Over 65%

less time required

(Accenture & McKinsey)

In today's fast-paced world, customers expect fast and efficient processes from insurance companies. By using intelligent automation technologies, insurers can meet these expectations and optimize their own business processes at the same time.

Process requests faster and more carefully

Potential policyholders expect fast processing when making an inquiry or checking documents and, in the best case, an offer within a few minutes. By automatically checking documents and processing customer data, quotes can be prepared more quickly and risks minimized. Employees then have more time to process exceptional cases.

Compliance with regulations and increasing employee satisfaction

Compliance with the many guidelines and regulations in the insurance industry is time-consuming. Employees have to check documents manually, transfer them to different target systems and are therefore inefficient and, not least, dissatisfied. Automated data processing can ensure compliance with guidelines and free up time for other activities. In addition, modernizing the systems reduces the risk of capital surcharges imposed by BaFin.

Time and cost savings

Automation helps insurance companies to reduce costs. By automating time-consuming and repetitive tasks, resources can be used more efficiently. This leads to a reduction in operating costs and an optimization of operational processes.

Use Case Insurance

Automated premium refunds

Automated premium refunds

Read how we have automated premium refunds for our customers:

- Industry: Insurance

- Department: Finance and accounting

- Automated systems: SAP, Logics, Excel, Outlook

- Technology used: Robotic Process Automation (RPA)

Other use cases that could be of interest to you:

Automation of

- claims processing

- contract management

- customer service

- compliance and regulation

- policy administration

Want to find out more about the individual use cases? Then contact us directly and we will explain how we can support you with automated processes.

Measurable success

We can deliver significant results for our customers through intelligent automation in insurance.

- 60 % faster

- 100 % error-free

- -47.000 € savings per year

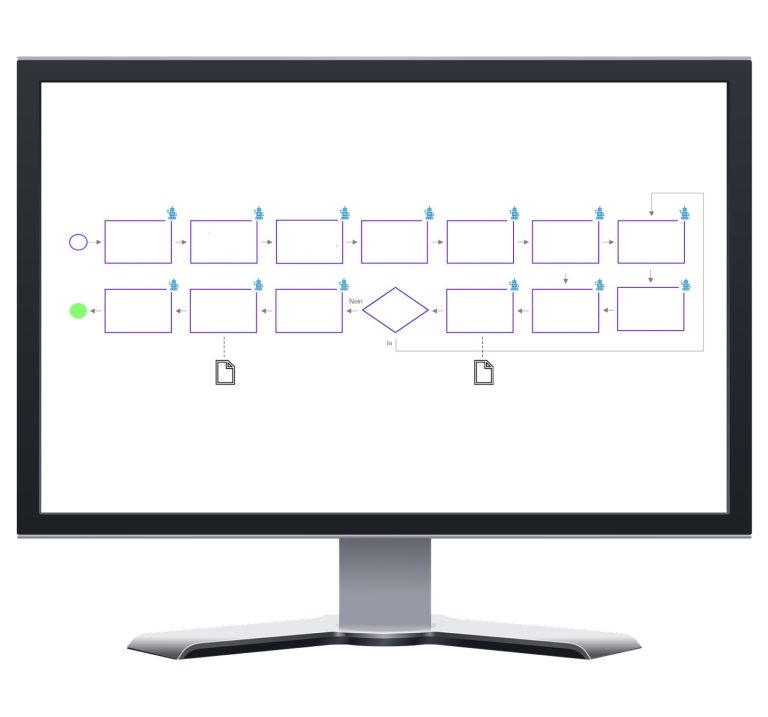

Humans and robots can work together in insurance.

The software robots that make up RPA solutions work on the basis of strict rules. In many situations, they are dependent on human input:

-When data needs to be verified

- When error messages and failures occur

- When real human contact is required

Robotic Process Automation (RPA) is one of those rare technologies that has the potential to impact every aspect of a business. In every industry and every field, there are repetitive and manual tasks that should be automated.

Complete more tasks with fewer errors - we'll show you how!

Talk to one of our experts now with no obligation.

Our technology partners